- Central Government vide Finance (No. 2) Act 2019 has prescribed the Sabka Vishwas (Legacy Dispute Resolution) Scheme ( SVLDS 2019)

- Time period for Declaration under the scheme is from 01 September 2019 till 31 December 2019.

- This scheme serves two objectives

.Dispute Resolution

.Amnesty.

- Objective of the scheme is one-time measure for liquidation of past disputes of central excise/service tax and other allied indirect laws (specified) and to provide a window of getting compliant , by way of voluntary disclosure to non - compliant tax payers.

- This scheme is applicable on the Central Excise Act, 1944, Chapter V of the Finance Act, 1994 (service tax Act) and 26 other enactments of Indirect taxes.

- The Scheme covers all types of pending disputes subject to certain exclusion. Exclusions are

.Matter pertaining to goods that are still subject to levy of Central Excise such as specified petroleum products and tobacco i.e. goods falling in the Fourth Schedule to the Central Excise Act, 1944

.Where the taxpayer/assessee has already been convicted in a Court of law

.Cases which are under adjudication or litigation where the final hearing has taken place on or before 30 June 2019

.Erroneous refunds being claimed / issued

.Pending before the Settlement Commission.

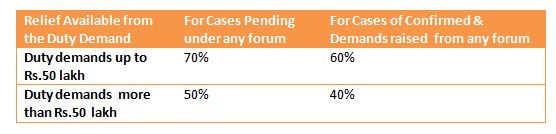

- Relief granted under the scheme can be summarized as follows

.If any Voluntary declaration, no relief available on duty amount.

.There will be full waiver of interest, penalty and prosecution in all the above cases.

- This is fully automated scheme with a dedicated portal (www.cbicgst.gov.in) for online filing of declaration and communication of final decision.

- Fixed timelines are to be strictly adhered for the various processes involved, so that the entire process of

.filing of declaration

.communication of Department's decision

payment of the duty gets completed within 90 days

- Payment of tax shall be through bank only and shall not be paid through the input tax credit and it would not be refunded under any circumstances.

- Payment of tax under the scheme shall not be taken as input tax credit.

- After payment of taxes under the scheme and submission of withdrawal of appeal in High Court and Supreme Court, if applicable, a discharge certificate will be issued indicating a full and final closure of the proceedings in question for both the Department and the taxpayer.

- Discharge certificate shall be conclusive as to the matter and time period stated therein. The declarant shall be not be liable to pay any further duty, interest or penalty. No matter and time period covered under a discharge certificate shall be reopened in any other proceedings under the said indirect tax enactments.

The only exception is in case of a taxpayer's voluntary disclosure of liability as there is no way to verify its correctness, so a provision is made to reopen such declaration within one year of issue of a discharge certificate, if subsequently any material particular is found to be false.

Leave a Comment